Renko and Heikin-Ashi Charts: Comprehensive Trading Guide

Time to read: 8 minutes

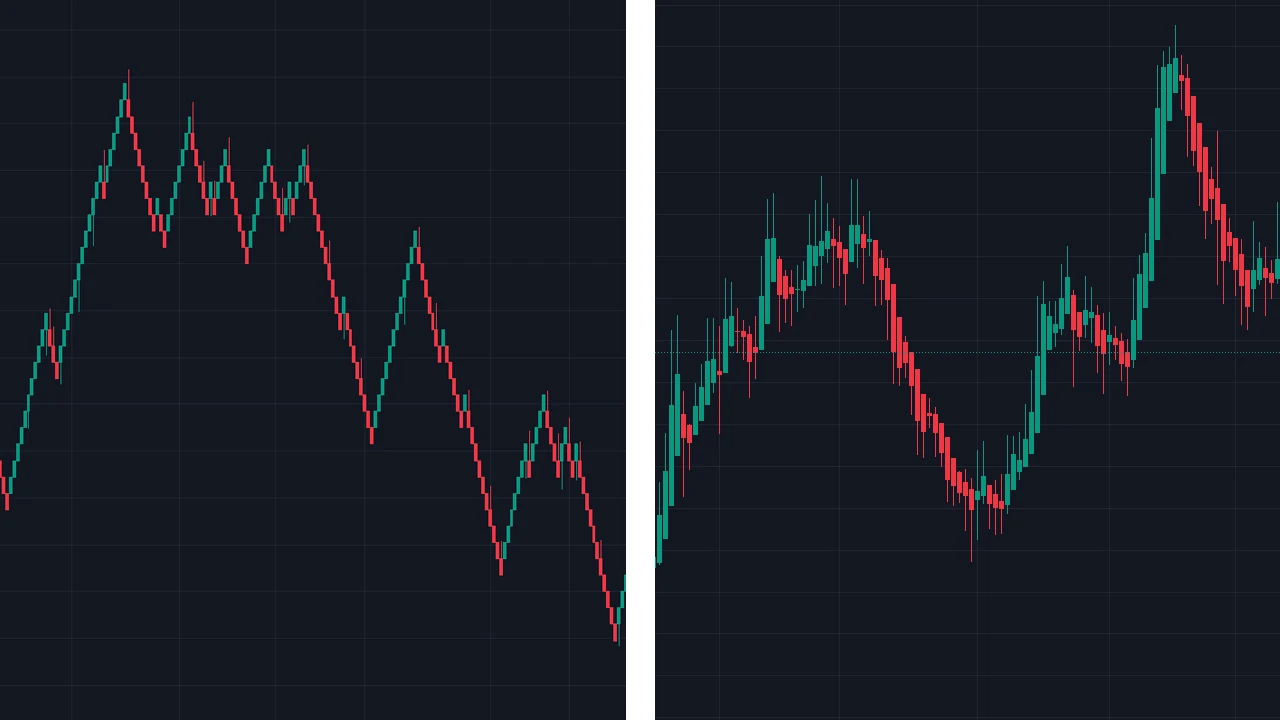

Discover how Renko and Heikin-Ashi charts simplify trend analysis and reduce noise, helping you make informed and confident trading decisions.

Renko and Heikin-Ashi Charts: Comprehensive Trading Guide

Renko and Heikin-Ashi Charts: Comprehensive Trading Guide

Unlock the potential of Renko and Heikin-Ashi charts in your trading strategy. Learn how these alternative charting techniques can provide clarity, reduce noise, and help you make more informed trading decisions.

1. Introduction to Alternative Charting Techniques

In forex trading, understanding market trends is critical for success. While traditional charting techniques, such as candlestick and bar charts, are highly popular, they often present challenges, especially during periods of high volatility or market noise. This is where alternative charting methods like Renko and Heikin-Ashi charts become invaluable.

Renko and Heikin-Ashi charts are designed to simplify trend analysis. They filter out insignificant price movements, making it easier for traders to identify major trends and key market reversals. By mastering these techniques, you can improve your ability to make data-driven decisions and enhance your overall trading performance.

Let's delve deeper into these charting methods and discover how they work, their unique features, and how you can apply them effectively to your trading strategy.

2. What are Renko Charts?

The Basics of Renko Chart Construction

Renko charts are named after the Japanese word "renga," which means "brick." True to their name, Renko charts are constructed using bricks that are added based on price movements rather than time intervals. Each brick represents a fixed price change, and a new brick is added only when the price moves by the specified amount. This construction method helps to eliminate minor fluctuations and highlights significant price movements more clearly.

To create a Renko chart, you first determine the brick size, which could be measured in pips, currency units, or a percentage of the asset’s price. For example, if you set the brick size to 10 pips, a new brick will only form if the price moves 10 pips above or below the closing price of the previous brick. This approach provides a simplified view of the market, making trends easier to spot.

How Renko Charts Filter Market Noise

One of the standout features of Renko charts is their ability to filter out market noise. Market noise consists of small, insignificant price movements that can make traditional charts difficult to interpret. By focusing only on substantial price changes, Renko charts offer a clearer and more focused view of the market's direction.

For instance, during a choppy trading session, a candlestick chart might show numerous conflicting signals, causing confusion for traders. A Renko chart, however, would smooth out these fluctuations, allowing traders to see the dominant trend more clearly. This makes Renko charts an excellent tool for long-term trend analysis.

Time Considerations in Renko Charts

Unlike time-based charts, Renko charts do not account for the passage of time. This means that a new brick may take minutes, hours, or even days to form, depending on the market's price movement. During periods of high market activity, new bricks can appear quickly, while in a stagnant market, it may take much longer for new bricks to form.

This characteristic makes Renko charts particularly useful for traders who focus on long-term trends rather than short-term price action. However, it's important to understand that the lack of time consideration means that Renko charts may not be suitable for every trading strategy, especially those that rely on precise timing.

Advantages of Using Renko Charts

Renko charts offer several compelling advantages for traders:

- Reduced Market Noise: By ignoring minor price fluctuations, Renko charts provide a cleaner view of the market, making it easier to identify trends.

- Simplified Trend Identification: The clear structure of Renko bricks helps traders easily recognize bullish and bearish trends, allowing for more confident trading decisions.

- Effective Support and Resistance Analysis: Renko charts naturally highlight key levels where price action has historically reacted, making it easier to spot potential areas of interest.

- Focus on Significant Moves: By only plotting substantial price changes, Renko charts ensure that traders concentrate on meaningful market movements.

Limitations of Renko Charts

Despite their advantages, Renko charts also come with certain limitations:

- Lagging Signals: Because Renko charts filter out noise, they may provide delayed signals in rapidly changing markets. This can be a drawback for traders who require real-time data.

- Not Suitable for Scalping: Renko charts are best suited for swing or trend trading. Scalpers and high-frequency traders may find them less effective for capturing quick, intraday price movements.

- Limited Real-Time Analysis: Since Renko charts do not consider time, they may not reflect the latest market conditions, which could be a disadvantage for time-sensitive trading strategies.

3. Trading Strategies Using Renko Charts

Identifying Trends with Renko Charts

One of the most effective ways to use Renko charts is to identify trends. A series of consecutive bricks of the same color indicates a strong trend. For example, if you see multiple green bricks, it suggests a bullish trend, while multiple red bricks indicate a bearish trend. Traders can use this information to enter trades in the direction of the trend and maximize their profits.

To enhance trend identification, consider using a larger brick size for major trends and a smaller brick size for more detailed analysis. By adjusting the brick size, you can tailor the chart to suit your trading style and objectives.

Support and Resistance Levels

Renko charts are highly effective for identifying support and resistance levels. The clear and consistent structure of the bricks makes it easy to spot areas where the price has reversed or consolidated. These levels can be used to plan your trades, set stop-loss orders, and determine take-profit targets.

For instance, if a Renko chart shows multiple bricks bouncing off a particular price level, that level is likely to be a significant support or resistance area. Traders can use this information to make informed decisions and improve their risk management.

Common Renko-Based Trading Strategies

Several trading strategies are based on the unique characteristics of Renko charts. Here are a few popular approaches:

- Trend Following: This strategy involves entering trades in the direction of the prevailing trend. For example, if the chart shows a series of green bricks, you would look for opportunities to go long. Conversely, if the chart shows red bricks, you would look for shorting opportunities.

- Breakout Trading: Use Renko charts to identify key support and resistance levels. When the price breaks through one of these levels and a new brick confirms the breakout, it can be a strong signal to enter a trade.

- Moving Average Crossover: Combining Renko charts with moving averages can help you create a reliable crossover strategy. When a shorter moving average crosses above a longer one, it signals a potential bullish trend, and vice versa for a bearish trend.

Combining Renko with Other Technical Indicators

Renko charts work well with a variety of technical indicators. For example, the Moving Average Convergence Divergence (MACD) indicator can be used to confirm trend strength. When the MACD line crosses above the signal line, it indicates bullish momentum, while a crossover below suggests bearish momentum.

Other useful indicators include the Relative Strength Index (RSI) and Bollinger Bands. The RSI can help identify overbought or oversold conditions, while Bollinger Bands can provide insights into market volatility and potential reversal points. By combining Renko charts with these indicators, you can improve your trading accuracy and confidence.

4. What are Heikin-Ashi Charts?

Understanding Heikin-Ashi Chart Construction

Heikin-Ashi charts are a variation of traditional candlestick charts that use a unique formula to smooth price action. The term "Heikin-Ashi" translates to "average bar" in Japanese, reflecting how these candles are calculated. Unlike traditional candlesticks, which show exact opening and closing prices, Heikin-Ashi candles use averages to create a smoother appearance.

The formula for calculating Heikin-Ashi candles is as follows:

- Open: The average of the previous Heikin-Ashi candle's open and close.

- Close: The average of the current candle's open, high, low, and close prices.

- High: The highest value among the current candle's high, open, or close.

- Low: The lowest value among the current candle's low, open, or close.

How Heikin-Ashi Charts Smooth Price Action

Heikin-Ashi charts smooth out price fluctuations, making trends more apparent. This is particularly useful for traders who want to stay in trades longer and avoid being shaken out by minor price movements. The smoothed appearance of Heikin-Ashi candles reduces the number of false signals and provides a clearer view of the market's overall direction.

In a strong uptrend, Heikin-Ashi candles will often have no lower shadows, indicating consistent upward momentum. Conversely, in a strong downtrend, the candles will have no upper shadows, signaling sustained downward pressure. This makes Heikin-Ashi charts ideal for trend-following strategies.

Difference Between Heikin-Ashi and Traditional Candlesticks

Traditional candlestick charts show exact price levels for each trading session, while Heikin-Ashi charts average these values to smooth out fluctuations. This makes Heikin-Ashi charts better suited for identifying trends, but they may lag behind real-time prices. Traders should be aware of this lag and use other indicators or charting techniques to confirm trade signals.

Advantages of Using Heikin-Ashi Charts

Heikin-Ashi charts offer several advantages that make them popular among traders:

- Clearer Trend Visualization: The smoothed candles make it easy to identify the direction of the trend, helping traders stay in trades longer.

- Reduced Market Noise: By averaging price data, Heikin-Ashi charts filter out minor fluctuations and false signals, providing a clearer picture of the market.

- Simple to Interpret: The simplified appearance of Heikin-Ashi candles makes them accessible to both novice and experienced traders.

- Helps in Avoiding False Signals: The smoothing effect reduces the likelihood of being misled by short-term price movements.

Limitations of Heikin-Ashi Charts

Despite their benefits, Heikin-Ashi charts are not without limitations:

- Lagging Indicator: Since Heikin-Ashi candles use averaged data, they may not reflect real-time market conditions, causing delays in entry or exit signals.

- Not Ideal for Scalping: The lag makes Heikin-Ashi charts less effective for short-term or high-frequency trading strategies.

- Requires Additional Confirmation: Traders should use other technical indicators to confirm Heikin-Ashi signals and manage risk effectively.

5. Trading Strategies Using Heikin-Ashi Charts

Spotting Trends and Reversals with Heikin-Ashi

Heikin-Ashi charts excel at identifying trends and potential reversals. When candles are consistently bullish (green) with no lower shadows, it indicates a strong uptrend. Conversely, a series of bearish (red) candles with no upper shadows suggests a strong downtrend. These trends can be used to make confident trading decisions and maximize profits.

Reversal signals can be spotted when the color of the candles changes or when doji-like candles (small bodies with long shadows) appear. These patterns often indicate a potential shift in momentum, giving traders an opportunity to adjust their positions or prepare for a change in trend direction.

Heikin-Ashi for Swing and Day Trading

Swing and day traders often use Heikin-Ashi charts to stay in trades longer and ride out trends. The smoothed price action allows them to focus on the bigger picture and avoid being shaken out by short-term volatility. Heikin-Ashi charts are particularly effective for identifying strong trends that can last for several trading sessions.

For day traders, Heikin-Ashi charts can be combined with intraday indicators like VWAP (Volume Weighted Average Price) or volume analysis to improve trade timing and decision-making. This combination helps traders focus on high-probability setups and manage risk more effectively.

Heikin-Ashi Candle Patterns to Watch For

There are several key candle patterns to watch for when using Heikin-Ashi charts:

- Strong Uptrend: A series of green candles with no lower shadows indicates a robust bullish trend and suggests staying long until the trend weakens.

- Strong Downtrend: A series of red candles with no upper shadows signals a strong bearish trend, indicating an opportunity for short positions.

- Reversal Patterns: Doji-like candles with small bodies and long shadows often indicate a potential reversal or pause in the current trend, prompting traders to be cautious.

Combining Heikin-Ashi with Other Technical Indicators

To maximize the effectiveness of Heikin-Ashi charts, traders should use them alongside other technical indicators. For example, the MACD indicator can be used to confirm trend strength. When the MACD line crosses above the signal line, it suggests bullish momentum, while a crossover below indicates bearish momentum.

Other indicators like the Stochastic Oscillator and ATR (Average True Range) can help identify overbought or oversold conditions and set appropriate stop-loss levels. Combining these tools with Heikin-Ashi charts can provide a well-rounded approach to trend-following and risk management.

6. Comparing Renko and Heikin-Ashi Charts

Similarities Between Renko and Heikin-Ashi

Both Renko and Heikin-Ashi charts are designed to simplify price action and make trend identification easier. They help traders reduce noise and focus on significant price movements, making them ideal for trend-following strategies. Both chart types are also highly visual and can be used alongside other technical analysis tools for a comprehensive approach.

For traders who prefer a clearer view of market trends, both charting techniques offer a way to filter out minor price fluctuations and make more confident trading decisions. However, each method has its own strengths and is better suited for specific types of analysis.

Key Differences in Chart Construction and Use Cases

While Renko charts focus solely on price movement and ignore time, Heikin-Ashi charts average price data over time to smooth out fluctuations. Renko charts are ideal for identifying support and resistance levels, while Heikin-Ashi charts excel at visualizing trends and smoothing out choppy price action.

Renko charts are often used for long-term trend analysis and are particularly useful in markets with clear directional movement. Heikin-Ashi charts, on the other hand, are popular among swing and day traders who want to stay in trades longer and filter out short-term noise.

When to Use Renko vs. Heikin-Ashi Charts

Use Renko charts when you want to focus on price movement and filter out noise to identify critical levels. Heikin-Ashi charts are ideal when you want to visualize trends and smooth out price action. Combining both techniques can give you a well-rounded view of the market and improve your trading strategy.

7. Practical Tips for Using Renko and Heikin-Ashi Charts

Selecting the Right Chart Settings

Choosing the appropriate settings for Renko and Heikin-Ashi charts is crucial for effective analysis. For Renko charts, selecting the right brick size is essential. A smaller brick size will show more detail but may generate more false signals, while a larger brick size will filter out minor movements and highlight major trends.

For Heikin-Ashi charts, the time frame you choose will affect the smoothness of the candles. Shorter time frames may still show some noise, while longer time frames will provide a clearer view of the overall trend. Experiment with different settings to find what works best for your trading style and market conditions.

Avoiding Common Mistakes

One common mistake traders make is relying solely on Renko or Heikin-Ashi charts without considering other forms of analysis. While these charts are powerful tools, they should be used in conjunction with other technical indicators and market analysis techniques to make well-informed trading decisions.

Another mistake is not adjusting the brick size or time frame to suit current market conditions. Be flexible and willing to adjust your settings based on volatility and market trends. Additionally, always backtest your strategies to ensure they are effective before implementing them in live trading.

Best Practices for Effective Chart Analysis

Here are some best practices to keep in mind when using Renko and Heikin-Ashi charts:

- Backtest Your Strategies: Always backtest your trading strategies using historical data to ensure they are effective and reliable.

- Use Stop-Loss Orders: Protect your capital by using stop-loss orders to manage risk. Set your stop-loss levels based on market volatility and your risk tolerance.

- Stay Updated on Market News: Keep an eye on market news and events that could impact price movements. Even the best technical analysis can be affected by sudden market shifts.

- Continuously Learn and Adapt: The forex market is constantly evolving, and successful traders are those who continuously learn and adapt to new strategies and market conditions.

8. Integrating Renko and Heikin-Ashi with Your Trading Plan

How to Combine Both Techniques for a Robust Strategy

Combining Renko and Heikin-Ashi charts can provide a more comprehensive view of the market. For example, you can use Renko charts to identify key support and resistance levels and then use Heikin-Ashi charts to confirm trend direction. This approach allows you to make more informed trading decisions and reduces the likelihood of false signals.

Another strategy is to use Renko charts for long-term analysis and Heikin-Ashi charts for short-term trades. This way, you can align your trades with the overall market trend while taking advantage of short-term price movements. By integrating both techniques into your trading plan, you can improve your trading performance and adaptability.

Examples of Real-World Applications

Consider a trader who uses Renko charts to identify a strong support level at 1.2000 in the EUR/USD currency pair. The trader waits for a Heikin-Ashi bullish reversal signal before entering a long trade. By combining both techniques, the trader can increase the probability of a successful trade and manage risk more effectively.

Another example is using Renko charts to spot a breakout above a resistance level. Once the breakout is confirmed, the trader switches to Heikin-Ashi charts to monitor the trend and stay in the trade as long as the trend remains intact. This approach provides a well-rounded strategy that takes advantage of both price movement and trend analysis.

Monitoring and Adjusting Your Approach

Trading is not a static activity. Continuously monitor your performance and be prepared to adjust your strategies as needed. If you notice that your current settings or indicators are not working well in certain market conditions, be flexible and adapt. The forex market is dynamic, and successful traders are those who can adjust to changing conditions.

Regularly review your trading plan and make adjustments based on your performance and market developments. Keep a trading journal to track your trades, analyze your successes and failures, and refine your strategies over time. This disciplined approach can help you become a more successful and resilient trader.

9. Conclusion

Renko and Heikin-Ashi charts are powerful tools that can simplify your trading and help you identify trends more effectively. By reducing market noise and providing clearer signals, these charts can enhance your trading performance and give you an edge in the market.

However, it's important to remember that no single tool or technique guarantees success. Use Renko and Heikin-Ashi charts as part of a comprehensive trading plan that includes risk management, continuous learning, and adaptation to market conditions. Whether you're a beginner or an experienced trader, practice and backtest your strategies before using them in live trading. Stay disciplined, stay informed, and never stop improving your trading skills.

10. FAQs on Renko and Heikin-Ashi Charts

What is the main advantage of using Renko charts?

Renko charts help filter out market noise and make it easier to identify key support and resistance levels, providing clearer signals for trend-following strategies. They are especially useful for long-term analysis and identifying major market trends.

Are Heikin-Ashi charts suitable for scalping?

Heikin-Ashi charts are not ideal for scalping because they smooth out price action and may lag behind real-time prices. They are better suited for swing or day trading, where trend-following strategies can be more effective.

Can I use both Renko and Heikin-Ashi charts together?

Yes, combining both techniques can provide a more complete view of the market. Use Renko charts to identify key support and resistance levels and Heikin-Ashi charts to confirm trends and spot potential reversals. This combination can help improve your trading accuracy and confidence.

How do I choose the right brick size for Renko charts?

The ideal brick size for Renko charts depends on the currency pair you're trading and the level of market volatility. A larger brick size will filter out more noise and show major trends, while a smaller brick size will display more detail but may generate more false signals. Experiment with different brick sizes to find what works best for your strategy.

What are some common indicators to use with Heikin-Ashi charts?

Popular indicators to use with Heikin-Ashi charts include Moving Averages, MACD, RSI, and Bollinger Bands. These indicators can help confirm trend strength, identify overbought or oversold conditions, and provide additional trade signals.

Add a comment

Leave your thoughts