Market Profile: Understanding Market Auction Theory

Time to read: 8 minutes

Master Market Profile and Auction Theory to improve your forex trading skills. Learn key concepts, strategies, and techniques to make informed trading decisions.

1. Introduction to Market Profile and Auction Theory

Market Profile is a revolutionary charting method that gives traders a new way to look at market activity. Developed from Auction Market Theory by J. Peter Steidlmayer, a trader at the Chicago Board of Trade, Market Profile provides insights into where trading activity is most concentrated. By understanding this, traders can make better decisions and improve their performance in forex trading and other financial markets.

Auction Market Theory describes how the market operates as a continuous auction between buyers and sellers. In this auction process, prices move up and down to find an equilibrium where the most transactions occur. This balance between supply and demand creates the framework for understanding market behavior. For forex traders, having a solid grasp of this concept is crucial as it can help them predict market movements and identify key areas of interest.

The forex market is highly liquid and operates 24 hours a day, making it the perfect environment to apply Market Profile analysis. Unlike other technical tools that may give mixed signals, Market Profile offers a more structured view of how the market behaves, highlighting areas of price acceptance and rejection. This understanding allows traders to align themselves with the market's natural movements rather than fighting against them.

2. Basic Concepts of Auction Market Theory

Understanding Market Auctions: Buyers vs. Sellers

At its core, Auction Market Theory views the market as an auction, where buyers and sellers compete to determine the fair value of an asset. Buyers place bids, indicating how much they are willing to pay, while sellers offer asks, showing how much they are willing to sell for. The interaction between these two forces drives market prices. When demand from buyers outweighs supply from sellers, prices rise, and when the opposite is true, prices fall.

In the forex market, this dynamic is constantly at play, with currencies being traded around the clock. The balance between buying and selling pressure creates patterns that can be analyzed using Market Profile. For instance, during times of economic news releases, you may notice significant price movement as the auction process intensifies. Understanding these market mechanics can give you an edge when planning your trades.

The market's auction process can be visualized as a two-sided battle between bulls and bears. When bulls are in control, they push prices higher, creating upward trends. Conversely, when bears dominate, prices move lower, forming downtrends. Recognizing these shifts in power can help you determine when to enter or exit trades, making your trading more effective and less risky.

Fair Value and Price Rejection

Fair value is a key concept in Auction Market Theory. It refers to the price level where both buyers and sellers agree on the value of an asset, resulting in high trading activity. This level often serves as a point of balance, and the market tends to gravitate around it until new information causes a shift. Traders should be aware of fair value zones, as these areas can act as magnets, attracting price action.

Price rejection occurs when the market tests a certain level but fails to stay there. This usually happens when the level is deemed unfair or unattractive by the majority of traders. Price rejection can lead to sharp reversals, offering excellent trading opportunities. For example, if a currency pair quickly moves up to a resistance level but gets rejected, it may indicate that sellers are stepping in, pushing the price back down.

Understanding price rejection is essential for spotting potential trend reversals. When you see rejection at a major support or resistance level, it may be a signal to consider taking a position in the opposite direction. However, always confirm with other indicators or market context before making a move.

The Role of Time in Auction Market Theory

Time is an often overlooked yet critical factor in Auction Market Theory. The amount of time the market spends at a particular price level indicates whether that price is being accepted or rejected. When the market stays at a price level for an extended period, it suggests acceptance, meaning that traders are comfortable transacting at that price. This creates areas of consolidation that can serve as key reference points for future price action.

On the other hand, if the market quickly moves away from a price level, it indicates rejection. Such areas are often characterized by sharp price movements and can act as support or resistance in the future. By analyzing time spent at various levels, traders can gauge market sentiment and identify potential trade setups.

Time-based analysis is crucial when trading forex, as the market's behavior can change dramatically throughout the day. For instance, during the overlap of the London and New York sessions, trading activity tends to increase, leading to higher volatility. Understanding how time influences market behavior can help you time your trades more effectively and avoid periods of low activity.

3. Components of a Market Profile

Price, Volume, and Time: The Three Pillars

Market Profile is based on three fundamental components: price, volume, and time. These elements work together to give traders a comprehensive understanding of market activity. Each component provides unique insights that, when combined, can offer a clearer picture of market dynamics.

Price: Price is the most straightforward component and represents the value at which trades occur. By analyzing price distribution over time, traders can identify important levels of support and resistance. For example, if a currency pair repeatedly bounces off a certain level, that level becomes significant, either as a support or resistance zone.

Volume: Volume measures the number of contracts or lots traded at each price level. It shows the intensity of trading activity and helps traders understand where major market participants are involved. High-volume areas often act as strong support or resistance, as they represent levels where significant buying or selling has occurred. In forex trading, volume data can sometimes be challenging to obtain, but many platforms offer proxies based on tick volume.

Time: Time indicates how long the market spends at each price level. The more time spent at a level, the greater the acceptance, suggesting that traders are comfortable transacting at that price. Conversely, if the market spends little time at a level, it indicates rejection. This time-based analysis helps traders identify areas of potential breakouts or reversals.

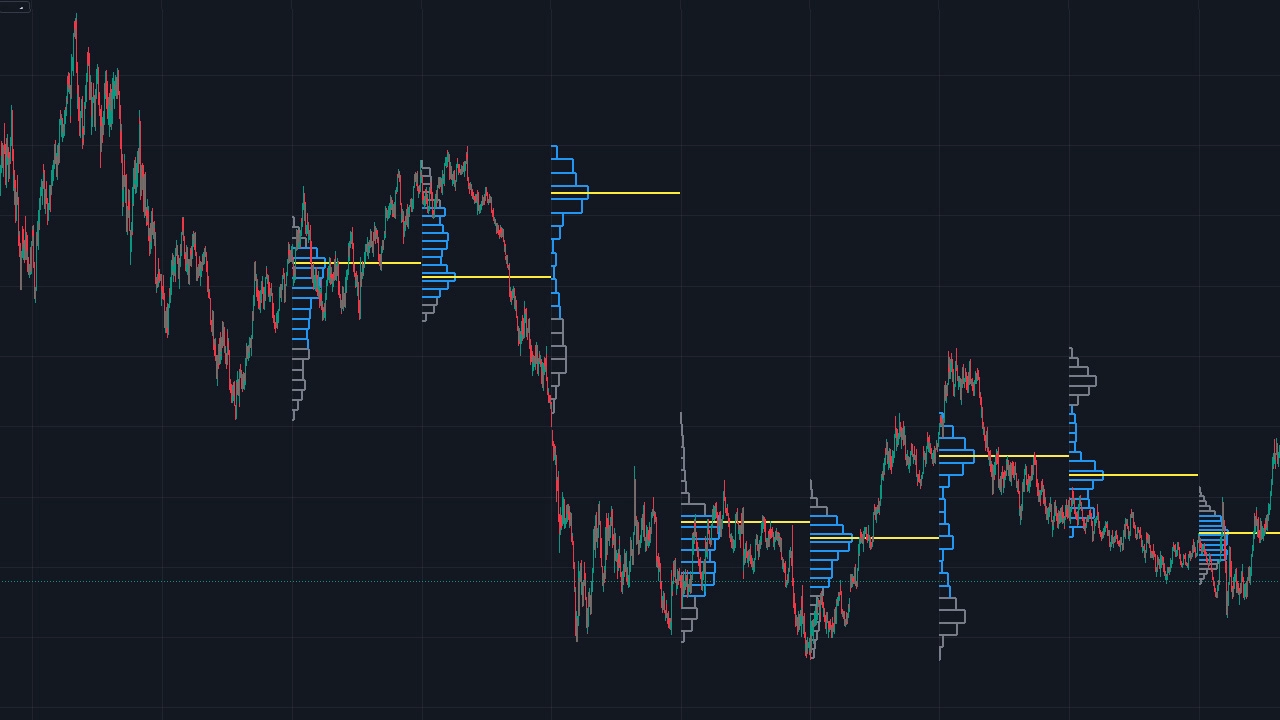

Profile Structures: Value Area, Point of Control, and Range

The Value Area, Point of Control (POC), and Range are essential elements of Market Profile analysis. Understanding these components can help traders identify key levels and anticipate future price movements.

Value Area (VA): The Value Area represents the price range where 70% of trading activity occurred during a given period. It highlights the zone where most market participants are active and comfortable trading. The Value Area High (VAH) and Value Area Low (VAL) act as natural boundaries and can serve as important support and resistance levels. Trading strategies often revolve around these boundaries, as price tends to oscillate between them in a balanced market.

Point of Control (POC): The POC is the price level with the highest traded volume during a session. It represents the most accepted price and often acts as a magnet for price action. If the market moves away from the POC, it may eventually return to it, especially if there is no new information driving the market. Traders use the POC to gauge market sentiment and identify potential reversal or continuation points.

Range: The Range defines the entire spread of prices traded during a session, from the highest to the lowest point. A wide range indicates high volatility, while a narrow range suggests low volatility. Understanding the market's range can help traders set realistic profit targets and stop-loss levels. In a trending market, the range may expand, while in a consolidating market, it may contract.

Market Profile Charts: How to Read Them

Market Profile charts display price, volume, and time data in a visual format. These charts use a series of letters or blocks, known as TPOs (Time Price Opportunities), to represent the time spent at each price level. The profile is divided into multiple columns, each representing a specific time period, such as 30 minutes or one hour.

When reading a Market Profile chart, pay attention to the overall shape of the profile. A balanced profile, which resembles a bell curve, indicates a stable market with no clear directional bias. An elongated profile, on the other hand, suggests a trending market, with price moving strongly in one direction. Recognizing these patterns can help you anticipate future price movements and develop effective trading strategies.

Another important aspect of Market Profile analysis is identifying single prints. Single prints occur when the market quickly moves through a price level, leaving a thin profile area. These areas often act as support or resistance, as they represent levels where the market was not willing to spend much time. By understanding how to interpret these features, you can make more informed trading decisions.

4. Market Profile Terminology

Initial Balance (IB)

The Initial Balance (IB) is the price range established in the first hour of trading. It serves as a critical reference point for the rest of the trading session. A narrow IB may indicate a breakout day, where the market is likely to trend strongly in one direction. Conversely, a wide IB suggests a range-bound day, with price likely to stay within the established boundaries.

Traders use the IB to gauge market sentiment and set up their trading strategies. If the market breaks out of the IB and shows strong momentum, it may indicate the start of a Trend Day. In such cases, traders can look for opportunities to trade in the direction of the breakout. On the other hand, if the market remains within the IB, it may present mean-reversion opportunities, where traders can buy at the lower boundary and sell at the upper boundary.

Value Area (VA)

The Value Area (VA) is the price range where 70% of trading activity took place during a session. It highlights the zone where most market participants are comfortable trading. The VA is divided into the Value Area High (VAH) and Value Area Low (VAL), which act as natural support and resistance levels. Price often oscillates between these levels, providing trading opportunities for those who understand how to use them effectively.

When trading near the VA boundaries, it's essential to watch for signs of price acceptance or rejection. If price breaks out of the VA and is quickly rejected, it may indicate a reversal. Conversely, if price breaks out and is accepted, it could signal a continuation of the trend. Understanding how to trade around the VA can improve your success rate and help you avoid false breakouts.

Point of Control (POC)

The Point of Control (POC) is the price level with the highest traded volume during a session. It represents the most accepted price and often acts as a magnet for price action. The POC can serve as a critical support or resistance level, as the market tends to revisit it frequently. If price moves away from the POC and fails to find acceptance at higher or lower levels, it may return to the POC, creating a mean-reversion opportunity.

Traders use the POC to gauge market sentiment and identify potential reversal points. If the POC shifts higher or lower, it indicates a change in market sentiment, which can provide clues about future price direction. By understanding the significance of the POC, you can make more informed trading decisions and better manage your risk.

Time Price Opportunity (TPO)

Time Price Opportunity (TPO) is a concept used in Market Profile to represent the time spent at each price level. Each TPO block indicates that the market traded at that price during a specific time interval, such as 30 minutes. By analyzing TPO clusters, traders can identify areas of price acceptance and rejection, which are crucial for making trading decisions.

TPO analysis helps traders understand market sentiment and identify key support and resistance levels. For example, a long TPO cluster at a certain price level indicates strong interest from traders, suggesting that the level is significant. On the other hand, a thin TPO cluster may indicate a level that is likely to be broken in the future. By incorporating TPO analysis into your trading strategy, you can gain a deeper understanding of market behavior.

5. Understanding Market Profile Structures

Types of Market Profile Days

Market Profile days can be categorized into different types based on their structure. Understanding these types can help traders anticipate market behavior and adjust their strategies accordingly. Here are the most common types of Market Profile days:

- Normal Day: A Normal Day features a balanced range, with trading activity concentrated around the POC. It indicates a market in equilibrium, where buyers and sellers are evenly matched. These days are typically less volatile, and price tends to oscillate within a defined range. Traders can use mean-reversion strategies to take advantage of these conditions.

- Trend Day: A Trend Day occurs when the market moves consistently in one direction, with minimal retracements. These days are characterized by an elongated profile, with price steadily climbing or falling throughout the session. Trend Days often result from significant news events or strong economic data, which drive the market in one direction. Traders can capitalize on these moves by entering trades in the direction of the trend and holding them for extended periods.

- Non-Trend Day: A Non-Trend Day is marked by limited movement, usually within a narrow range. It suggests a lack of conviction from both buyers and sellers, and the market may remain in a state of indecision. These days are often followed by a breakout, as the market eventually chooses a direction. Traders should be cautious on Non-Trend Days and avoid taking large positions until a clear trend emerges.

- Neutral Day: A Neutral Day has equal movement in both directions, with the market closing near the opening price. It indicates indecision and can signal a potential reversal or continuation in the coming days. On Neutral Days, traders should be flexible and prepared to trade in either direction, depending on how the market reacts to key levels.

Identifying Key Trading Levels

Market Profile helps traders pinpoint significant trading levels, such as support and resistance zones. These levels are based on historical volume and price activity, providing reliable reference points for trading decisions. By analyzing where the market has shown interest or rejection in the past, traders can anticipate future price movements and set up trades accordingly.

For example, if a currency pair has repeatedly bounced off a certain support level, that level becomes a key area to watch. If price approaches this level again, traders can look for signs of buying interest or rejection. Similarly, if a resistance level has been tested multiple times, it may act as a barrier to further price movement. Understanding these key trading levels can improve your accuracy and help you manage risk more effectively.

Single Prints and Excess

Single prints occur when the market trades quickly through a price level, leaving a thin profile area. These areas often represent gaps or low-volume zones and can act as strong support or resistance levels. For example, if the market leaves single prints during a rapid uptrend, those levels may act as support if the market retraces. Conversely, if single prints occur during a downtrend, they may act as resistance on the way back up.

Excess refers to the sharp rejection of a price level, signaling that the market has reached an extreme and may be ready to reverse. Excess is often characterized by long wicks on candlestick charts or a thin Market Profile at the top or bottom of a range. Recognizing excess can help traders avoid entering trades at the end of a trend and instead look for potential reversal opportunities. By incorporating single prints and excess into your analysis, you can better understand market dynamics and improve your trading strategy.

6. Market Profile and Trading Strategies

Using Market Profile to Identify Trading Opportunities

Market Profile provides traders with valuable insights into market sentiment and key trading levels. By analyzing profile structures, traders can identify areas where price is likely to react, making it easier to plan trades. For example, trading near the Value Area High or Low can offer high-probability setups, especially when combined with other technical indicators.

One effective strategy is to wait for the market to test the Value Area boundaries. If the market rejects the Value Area High, it may indicate a potential short trade, while rejection of the Value Area Low could suggest a buying opportunity. These trades are often low-risk, as the market is likely to move back toward the POC. However, always use proper risk management to protect your capital.

Another strategy involves trading breakouts from the Initial Balance. If the market breaks out of the IB and shows strong momentum, it may signal the start of a Trend Day. Traders can enter in the direction of the breakout and ride the trend, using trailing stops to lock in profits. On the other hand, if the market fails to break out and remains within the IB, it may present mean-reversion opportunities.

Trading the Open: Strategies Based on Initial Balance

Trading the open can be highly profitable if done correctly. The Initial Balance, formed in the first hour of trading, provides clues about market sentiment. If the market breaks out of the IB and shows strong momentum, it may indicate a Trend Day. In such cases, traders can look for opportunities to trade in the direction of the breakout.

On the other hand, if the market remains within the Initial Balance range, it suggests a range-bound day. Traders can use mean-reversion strategies, buying near the lower boundary and selling near the upper boundary, with stop-loss orders to manage risk. It's important to monitor volume and momentum during the open, as these factors can confirm or refute your trade setups.

Combining Market Profile with Other Technical Analysis Tools

Market Profile can be used in conjunction with other technical analysis tools to enhance trading accuracy. For example, combining Market Profile with moving averages, Fibonacci retracements, or candlestick patterns can provide additional confirmation for trade setups. By using multiple tools, traders can filter out false signals and increase their chances of success.

One popular approach is to use Market Profile to identify key levels and then look for candlestick patterns or momentum indicators to confirm entry points. For instance, if the market is approaching the Value Area Low and forms a bullish engulfing pattern, it may signal a potential buying opportunity. By combining different forms of analysis, you can create a more robust trading strategy that adapts to changing market conditions.

7. Advantages and Limitations of Using Market Profile

Benefits of Using Market Profile in Forex Trading

Market Profile offers several advantages for forex traders. It provides a clear view of market sentiment, helping traders understand where significant buying and selling are occurring. This information is invaluable for identifying key support and resistance levels, as well as anticipating market reversals and continuations.

Another benefit is that Market Profile allows traders to see the market's underlying structure, which is often hidden in traditional price charts. By understanding how volume and time interact with price, traders can make more informed decisions and develop more effective trading strategies. Additionally, Market Profile can be used in all types of markets, whether trending, ranging, or volatile, making it a versatile tool for any trading style.

Common Challenges and How to Overcome Them

Despite its benefits, Market Profile can be challenging to master. One common issue is the complexity of interpreting profile data. Beginners may find it overwhelming to analyze multiple elements, such as Value Areas, POCs, and single prints. Overcoming this challenge requires practice and continuous learning. Start by focusing on the basics and gradually build your understanding of more advanced concepts.

Another limitation is that Market Profile is not a standalone trading tool. It works best when used in combination with other analysis methods, such as trend analysis or momentum indicators. Traders should also be aware of market conditions, as Market Profile may be less effective in highly volatile or low-liquidity environments. By using a well-rounded approach, you can maximize the benefits of Market Profile and minimize its limitations.

8. Practical Examples and Case Studies

Analyzing Real-World Market Profile Charts

Let's look at some real-world examples to understand how Market Profile can be used to identify trading opportunities. In one case, a trader noticed a strong POC level acting as support during an uptrend. When the market retraced to this level and showed signs of buying interest, the trader entered a long position and profited from the subsequent rally.

In another example, a trader observed a Trend Day forming with an elongated profile. By recognizing the breakout from the Initial Balance and entering in the direction of the trend, the trader was able to capture significant gains. These case studies highlight the importance of understanding Market Profile structures and using them to make informed trading decisions.

Case Studies: Successful and Unsuccessful Trades

Examining both successful and unsuccessful trades can provide valuable lessons. For instance, a trader may have entered a short trade at the Value Area High, expecting a reversal. However, if the market continued to trend upward and broke through the POC, the trade would have resulted in a loss. Analyzing what went wrong can help traders refine their strategies and avoid similar mistakes in the future.

Conversely, a successful trade may involve recognizing a breakout from the Initial Balance and entering in the direction of the move. By using Market Profile to identify key levels and confirm trade setups, traders can increase their chances of success. Reviewing case studies regularly can improve your understanding of Market Profile and help you develop more effective trading strategies.

9. Tips for Implementing Market Profile in Your Trading Plan

Setting Up Market Profile Charts

Setting up Market Profile charts correctly is crucial for effective analysis. Use reliable charting software that offers Market Profile features and customize the settings to your preferences. Focus on key elements like the Value Area, POC, and TPO clusters, and practice analyzing historical data to build your skills.

When setting up your charts, consider using multiple time frames to gain a better understanding of market structure. For example, you can use a higher time frame to identify major support and resistance levels and a lower time frame to fine-tune your entries and exits. This multi-time-frame approach can help you see the bigger picture and avoid getting caught in false breakouts or reversals.

Risk Management and Position Sizing

Risk management is a vital aspect of any trading strategy. When trading based on Market Profile, always use stop-loss orders to protect your capital. Position sizing is equally important, as it ensures that you don't risk too much on any single trade. Use a risk-to-reward ratio of at least 1:2 to maximize your potential profits while minimizing losses.

One effective risk management technique is to calculate your position size based on the distance between your entry and stop-loss levels. For example, if your stop-loss is 50 pips away, adjust your position size so that you only risk a small percentage of your account, such as 1-2%. This way, even if the trade goes against you, your losses will be manageable.

Developing a Market Profile-Based Trading Routine

Consistency is key to success in trading. Develop a daily routine that includes analyzing Market Profile charts, identifying key levels, and planning your trades. Review your trades at the end of each day to learn from your successes and mistakes. By following a structured approach, you can improve your trading discipline and increase your chances of success.

Incorporate journaling into your trading routine to track your progress and identify areas for improvement. Write down your trade setups, reasons for entering or exiting trades, and the outcome of each trade. Reviewing your journal regularly can help you spot patterns in your behavior and make necessary adjustments to your strategy.

10. Advanced Market Profile Concepts (Optional)

Market Profile and Order Flow Analysis

Advanced traders often use order flow analysis in conjunction with Market Profile. Order flow provides real-time data on buying and selling activity, allowing traders to see the actual orders being placed in the market. This information can be used to confirm or refute trading signals generated by Market Profile. For example, if the market is approaching the Value Area Low and order flow shows strong buying interest, it may be a good opportunity to go long.

Order flow analysis requires specialized software and can be challenging to master. However, it offers a deeper understanding of market dynamics and can provide an edge in fast-moving markets. If you're interested in learning order flow, start by studying the basics and gradually incorporate it into your trading plan.

Integrating Market Profile with Volume Profile

Volume Profile is another powerful tool that complements Market Profile. While Market Profile focuses on time-based data, Volume Profile highlights the volume traded at each price level. By integrating both tools, traders can gain a more comprehensive understanding of market dynamics and identify high-probability trading opportunities.

For example, if both Market Profile and Volume Profile indicate strong support at a certain level, it increases the likelihood of a successful trade. Conversely, if the profiles show conflicting signals, it may be best to stay on the sidelines. Combining these tools can provide a more holistic view of the market and improve your decision-making process.

Using Market Profile in Different Market Conditions

Market conditions can change rapidly, and traders must adapt their strategies accordingly. In trending markets, focus on breakout strategies and use Market Profile to identify continuation patterns. In range-bound markets, look for mean-reversion opportunities near the Value Area boundaries. Understanding how Market Profile behaves in different environments can improve your trading adaptability.

When trading in volatile markets, be cautious and adjust your position size to account for increased risk. Volatility can lead to false breakouts and unpredictable price movements, so always have a clear plan and stick to your risk management rules. By staying flexible and adapting to market conditions, you can navigate different trading environments more effectively.

11. Conclusion and Final Thoughts

Mastering Market Profile and Auction Theory takes time and dedication. By understanding the core concepts and learning how to interpret profile structures, traders can gain a significant edge in the forex market. Practice is essential, so spend time analyzing historical data and refining your strategies.

Remember that no trading strategy is foolproof. The key to long-term success is continuous learning and adapting to changing market conditions. Stay disciplined, manage your risk, and always be open to improving your trading approach. With persistence and a solid understanding of Market Profile, you can become a more confident and successful trader.

Keep in mind that trading is a journey, not a destination. Even experienced traders continue to learn and adapt as markets evolve. By staying committed to your education and remaining flexible, you can achieve your trading goals and build a sustainable trading career.

12. FAQs and Troubleshooting Common Issues

Common Questions About Market Profile

Here are some common questions traders have about using Market Profile:

- What is the best time frame for Market Profile analysis? The best time frame depends on your trading style. Day traders may prefer shorter time frames, such as 15-minute charts, while swing traders may use daily or weekly profiles. Experiment with different time frames to see what works best for you.

- How do I know if a breakout is genuine? Look for confirmation from volume and momentum indicators. A genuine breakout is often accompanied by high volume and strong price movement. If the breakout lacks volume, it may be a false move, and the market could reverse.

- Can Market Profile be used in all markets? Yes, Market Profile is versatile and can be used in forex, futures, and even stock markets. However, it works best in liquid markets with high trading volume. Be cautious when applying it to illiquid or thinly traded markets.

- Is Market Profile suitable for beginners? Market Profile can be complex, but beginners can start by learning the basics and gradually incorporating it into their analysis. Practice and continuous learning are key to mastering this tool.

Solutions to Common Problems in Market Profile Trading

Interpreting Market Profile data can be challenging. Here are some solutions to common problems:

If you're struggling to identify key levels, simplify your analysis by focusing on the Value Area and POC. Avoid overcomplicating your strategy with too many indicators. Practice regularly and review your trades to understand what works and what doesn't. Continuous learning and adaptation are the keys to overcoming these challenges.

Additionally, consider joining trading communities or forums where you can discuss Market Profile concepts with other traders. Sharing insights and learning from others can accelerate your understanding and improve your trading skills. Remember, the market is always evolving, so stay open to new ideas and be willing to adjust your approach as needed.

Add a comment

Leave your thoughts